Comenity victoria secret bill pay – Comenity Victoria’s Secret bill pay offers several convenient methods for managing your credit card account. Understanding these options, from online portals to mail-in payments, is crucial for responsible credit card management. This guide explores the various ways to pay your Victoria’s Secret credit card bill, highlighting the advantages and disadvantages of each method, and addressing common issues that may arise.

This comprehensive guide covers everything from accessing your online account and utilizing the mobile app (if available) to understanding late payment fees and contacting customer service. We’ll delve into the security measures Comenity Capital Bank employs to protect your information and offer tips for maintaining the security of your online transactions. Whether you prefer the convenience of online payments or the traditional method of mailing a check, this guide provides the necessary information to manage your Victoria’s Secret credit card account efficiently and securely.

Comenity Capital Bank and Victoria’s Secret Credit Cards: A Comprehensive Guide to Bill Payment: Comenity Victoria Secret Bill Pay

This article provides a detailed guide to understanding Comenity Capital Bank’s Victoria’s Secret credit cards, managing your account, and making timely payments. We will cover various payment methods, troubleshooting common issues, and understanding the implications of late payments.

Comenity Capital Bank and Victoria’s Secret Credit Cards, Comenity victoria secret bill pay

Comenity Capital Bank is a private label credit card issuer that partners with various retailers, including Victoria’s Secret. This partnership allows Victoria’s Secret to offer its own branded credit cards to customers, providing benefits tailored to their shopping habits. Comenity manages the accounts, processes payments, and handles customer service for these cards.

Victoria’s Secret offers several credit card options through Comenity, each with varying interest rates, rewards programs, and fees. Specific card details, including APRs and fees, are subject to change and should be verified on the Comenity website or your credit card agreement.

A comparison of potential interest rates and fees across different Victoria’s Secret credit cards might show a range, for example, from 20% to 30% APR and annual fees that could range from $0 to $50 (or more, depending on the card and the cardholder’s creditworthiness). It is crucial to review the specific terms and conditions of each card before applying.

Locating Bill Pay Information

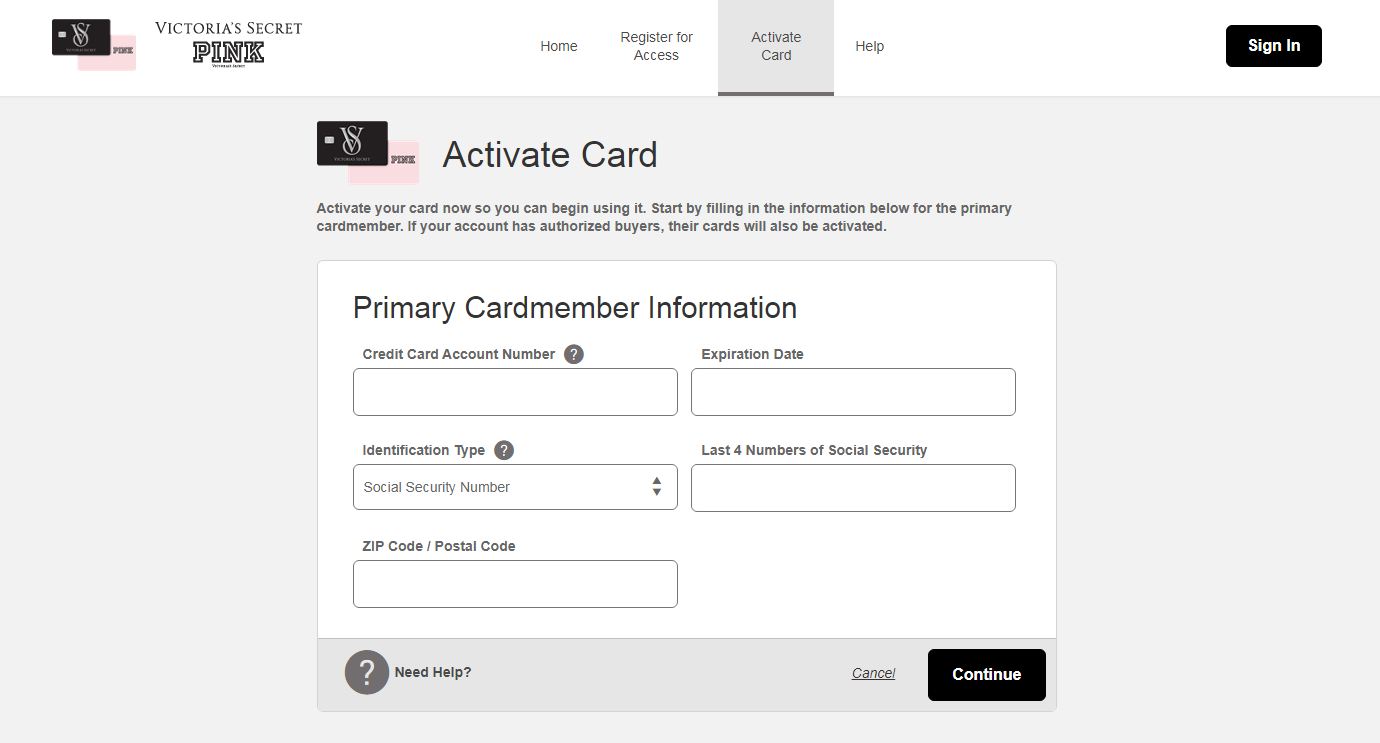

Comenity Capital Bank’s online bill pay system can be accessed through their official website. The URL is typically found on your credit card statement or by searching “Comenity Capital Bank” online. The specific URL may vary slightly over time, so always verify its legitimacy before entering your account information.

- Navigate to the Comenity Capital Bank website.

- Locate the “Login” or “Make a Payment” button, usually prominently displayed on the homepage.

- Enter your credit card account number and other required login credentials.

- Once logged in, you’ll find options to view your statement, make a payment, and manage your account settings.

A mobile app, if available, offers similar functionality. The process generally involves downloading the app, logging in with your account credentials, and selecting the “Make a Payment” option. The app will guide you through the payment process, allowing you to select a payment amount and method.

Alternative Bill Payment Methods

Besides online payment, alternative methods for paying your Victoria’s Secret Comenity credit card bill include mail and phone payments. Each method has its advantages and disadvantages.

| Method | Process | Advantages | Disadvantages |

|---|---|---|---|

| Online | Access the Comenity website, log in, and make a payment using various methods. | Convenient, fast, secure, and allows for payment tracking. | Requires internet access; potential for technical issues. |

| Send a check or money order payable to Comenity Capital Bank to the address provided on your statement. Include your account number. | No technology needed; may be preferred by some customers. | Slower processing time; risk of mail loss or delay; requires writing a check. | |

| Phone | Contact Comenity customer service by phone and provide payment information. (This may involve automated systems or direct interaction with a representative.) | Convenient for those without online access; allows for immediate payment confirmation. | May require longer wait times; may not be available 24/7; may incur additional fees. |

Managing Your Victoria’s Secret Credit Card Account

Registering for online account access provides convenient account management. You can typically register by visiting the Comenity website, clicking on a link like “Register Now” or “Manage Account,” and following the instructions to create an online profile.

- Viewing statements: Access past and current statements online.

- Setting up autopay: Automate recurring payments to avoid late fees.

- Updating personal information: Modify your address, phone number, and email address.

Updating your personal information is usually done through the account settings section of the online portal. Follow the prompts to make the necessary changes. Ensure accuracy to prevent payment issues.

Troubleshooting Common Bill Payment Issues

Common online payment problems include incorrect login credentials, insufficient funds, and payment processing errors. Solutions often involve double-checking login information, verifying available funds, and contacting Comenity customer service if the issue persists.

A flowchart would visually represent troubleshooting steps. For example, it could start with “Payment Issue?”, branching to “Incorrect Login?” (with solutions like password reset), “Insufficient Funds?” (with solutions like adding funds), and “Payment Processing Error?” (with solutions like contacting customer support). Each branch would lead to a resolution or further troubleshooting steps.

Understanding Late Payment Fees and Consequences

Late payments on a Victoria’s Secret Comenity credit card can result in late payment fees, a negative impact on your credit score, and potential account suspension. Specific fees and consequences are detailed in your credit card agreement. These fees can range from $25 to $40 or more, depending on the card and the issuer’s policies.

To avoid late fees, set up automatic payments, reminders, or utilize online bill pay features to ensure timely payments. Paying at least the minimum payment due before the due date is crucial.

Customer Service Contact Information

Comenity Capital Bank provides various customer service channels. Their website usually lists a phone number, email address, and mailing address. Response times may vary depending on the method; phone support often offers the quickest response, while email may take longer.

For descriptions on additional topics like or coast craigslist, please visit the available or coast craigslist.

Example contact information (Note: This is example information and may not be current. Always check the Comenity website for the most up-to-date contact details.):

- Phone: 1-800-XXX-XXXX

- Email: [email protected] (Example)

- Mailing Address: Comenity Capital Bank, PO Box 659, Minneapolis, MN 55440 (Example)

Security and Privacy of Online Bill Payment

Comenity Capital Bank employs security measures such as encryption and fraud detection systems to protect customer information during online transactions. Their privacy policy Artikels how they collect, use, and protect customer data. This policy is typically available on their website.

Best practices for protecting personal information include using strong passwords, avoiding public Wi-Fi for sensitive transactions, and regularly monitoring your account statements for any unauthorized activity. Never share your account information via email or unsecured websites.

Successfully managing your Comenity Victoria’s Secret credit card involves understanding the various payment options available and proactively addressing any potential issues. By utilizing the online portal, mobile app, or alternative methods, and by staying informed about late payment fees and account security, you can maintain a healthy financial standing. Remember to always prioritize secure payment methods and promptly address any account-related inquiries with Comenity Capital Bank’s customer service.